Wisconsin Corporate Income Tax Extension Form

Form 1138 Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback PDF. Wisconsin Tax Extension Tips.

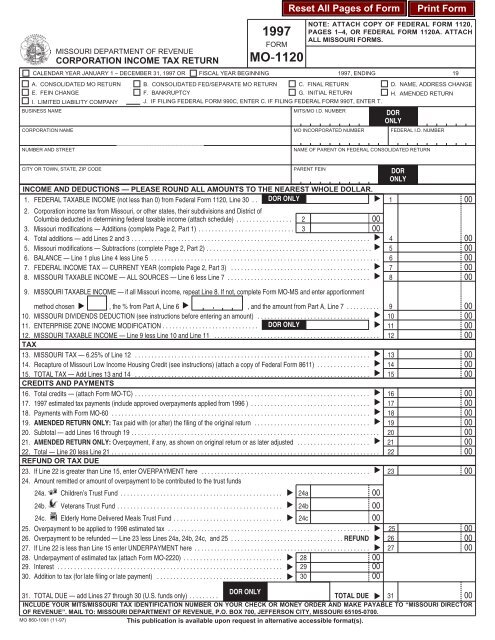

Mo 1120 Corporation Income Tax Return Mo Ft Franchise Tax Form

Mo 1120 Corporation Income Tax Return Mo Ft Franchise Tax Form

In that case the application must be postmarked on or before the business day following such Saturday Sunday or legal holiday.

Wisconsin corporate income tax extension form. Business franchise or income tax return Form 4T to report unrelated business taxable income. You can download or print current or past-year PDFs of Form 6 directly from TaxFormFinder. This extension is for filing only.

If you live in WISCONSIN. Wisconsin will follow the IRS due date extensions so residents have until May 17 to file for a. If you need to make a payment you can mail the form at the bottom of the worksheet with your check.

To avoid other penalties and interest you must pay any tax owed by the regular due date and file. 182 rows 1192020 357 PM. You do not have to submit a separate form requesting an extension to file.

More about the Wisconsin Form 6 Corporate Income Tax Tax Return TY 2020 We last updated the Wisconsin Combined Corporation Franchise or Income Tax Return in March 2021 so this is the latest version of Form 6 fully updated for tax year 2020. You can make a state extension payment using Wisconsin Form 4-ES. These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS filing individual federal tax returns in Wisconsin during Calendar Year 2021.

189 rows 11272019 1230 PM. The Wisconsin Department of Revenue grants an automatic six-month extension of time to file your Wisconsin income tax return if you obtain a federal extension of time to file provided you attach a copy of a valid federal Form 4868 to your Wisconsin income tax. You automatically have until October 15 to file before we charge a late filing penalty.

To make a Wisconsin extension payment use Form Corp-ES Wisconsin Corporation Estimated Tax Voucher. Individual Income Tax Return with only the name address and signature areas completed. 1 Federal extensions.

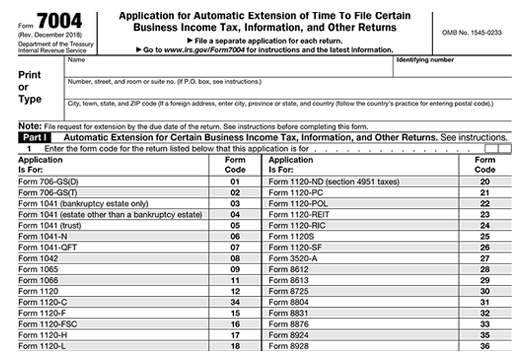

Or you can use our free secure QuickPay service online. Wisconsin partnership tax returns are due by the 15 th day of the 4 th month after the end of the tax year April 15 for calendar year filers. Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns PDF.

Wisconsin offers a 5-month extension for partnerships which moves the. To obtain an extension only for Wisconsin you must attach a statement to your Wisconsin income tax return indicating you wish to take the federal Form 4868 extension provision or attach a copy of the federal Form 4868 Application for Automatic Extension of Time to File US. Residents waiting to file 2020 income tax return paperwork will have more time to do so this year.

Form 5S Wisconsin Tax-Option S Corporation Franchise or Income Tax. The completed extension form must be filed by the original due date of the return unless the original due date falls on Saturday Sunday or a legal holiday. This is not a request for extension to pay.

Partnership tax returns are due by April 15 or by the 15 th day of the 4 th month following the end of the taxable year for fiscal year filers. If you owe Wisconsin tax it must be paid by the original due date to avoid penalties and interest. After you finish the worksheet do one of the following.

And you ARE NOT ENCLOSING A PAYMENT then. A partnership can obtain a 5-month Wisconsin tax extension. Form 41ES is for business income tax.

57 rows Tax Return. Form 5S - Tax-Option S Corporation Franchise or Income Tax Return Form 3 - Partnership Return PW-1 - Nonresident Income or Franchise Tax Withholding on Pass-Through Entity Income. And you are filing a Form.

Any extension of time granted by federal law or by the IRS for filing a federal corporation tax return or exempt organization business tax return automatically extends the for filing the corresponding date Wisconsin return.

Wisconsin Form Wi Z And Form 1a Eliminated For Tax Year 2018

Wisconsin Form Wi Z And Form 1a Eliminated For Tax Year 2018

Tennessee Tax Forms 2020 Printable State Tn Inc 250 Form And Tn Inc 250 Instructions

Tennessee Tax Forms 2020 Printable State Tn Inc 250 Form And Tn Inc 250 Instructions

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Virginia Tax Forms 2020 Printable State Va 760 Form And Va 760 Instructions

Virginia Tax Forms 2020 Printable State Va 760 Form And Va 760 Instructions

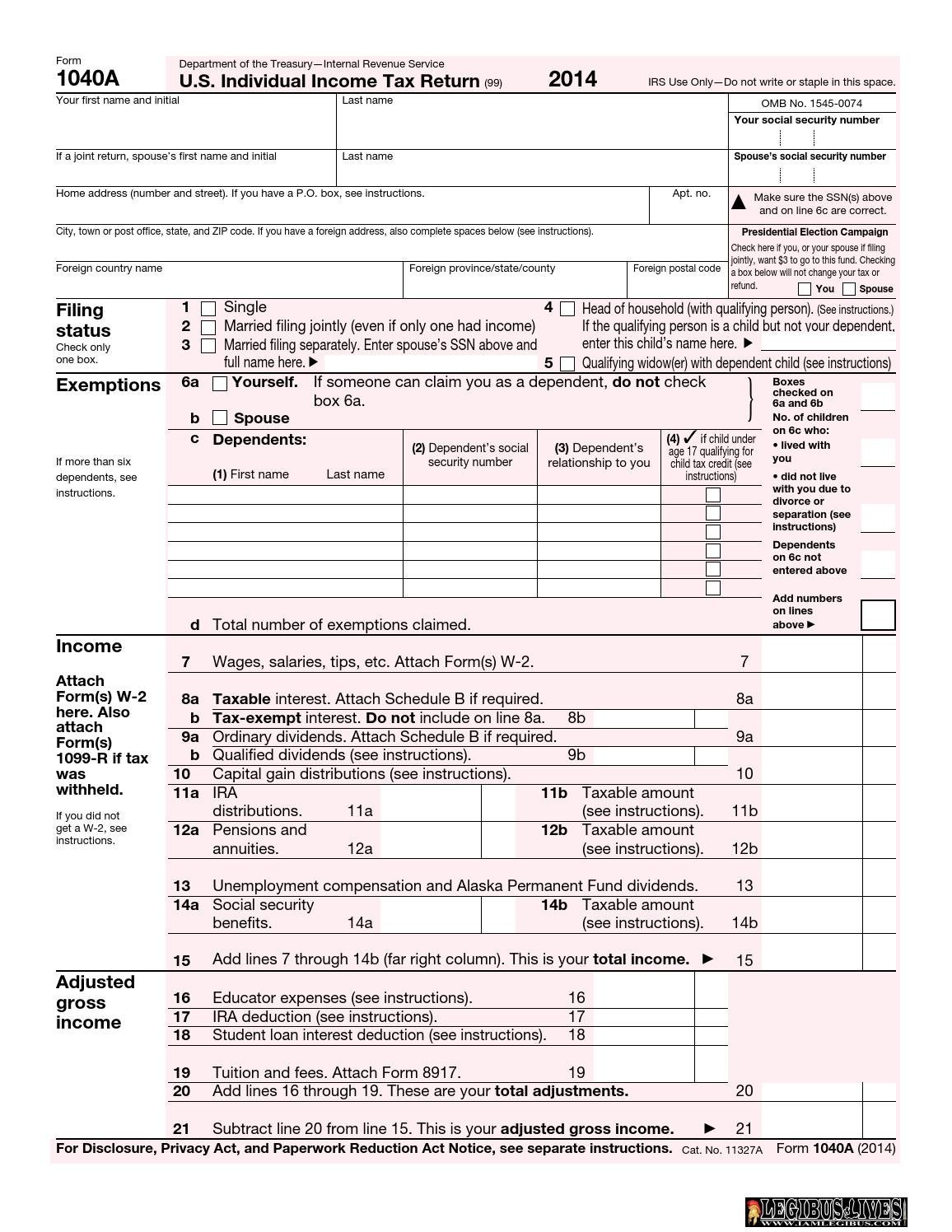

U S Individual Income Tax Return Forms Instructions Tax Table F1040a I1040a I1040tt By Legibus Inc Issuu

U S Individual Income Tax Return Forms Instructions Tax Table F1040a I1040a I1040tt By Legibus Inc Issuu

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition Private School School Address

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition Private School School Address

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Power Of Attorney Form Tax Return Student Loan Interest

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Power Of Attorney Form Tax Return Student Loan Interest

New Mexico Tax Forms And Instructions For 2020 Form Pit 1

New Mexico Tax Forms And Instructions For 2020 Form Pit 1

New Hampshire Tax Forms 2020 Printable State Nh Dp 10 Form And Nh Dp 10 Instructions

New Hampshire Tax Forms 2020 Printable State Nh Dp 10 Form And Nh Dp 10 Instructions

Hawaii Tax Forms And Instructions For 2020 Form N 11

Hawaii Tax Forms And Instructions For 2020 Form N 11

Missouri Tax Forms 2020 Printable State Mo 1040 Form And Mo 1040 Instructions

Missouri Tax Forms 2020 Printable State Mo 1040 Form And Mo 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions